Top headline: The Manila Times, 6/15/2022

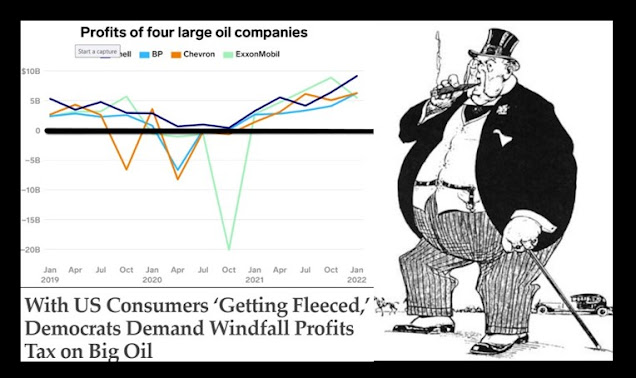

Chart: Business Insider, 5/17/2022

Caricature: Tank Terminals

Bottom headline: Oil Price

This makes the EY report the latest in an increasingly long series of reports documenting a major shift in the oil and gas industry as it adjusts to a chronically uncertain environment, in which they cannot know how long there will be demand for their product.

Ironically, this uncertainty has been a big reason for the latest price surge that began last year because of that changing attitude that made oil and gas explorers and producers wary of spending too much on new supply.

8/4/2022 update starts here

Top headline: The Manila Times, 6/15/2022

Chart: Business Insider, 5/17/2022

Caricature: Tank Terminals

Bottom headline: Deseret News

Oil drilling titans Chevron, Exxon Mobile, Shell and BP all released their latest quarterly earnings reports over the last few days and most of them hit new, all-time profit records for the second quarter of 2022. [emphasis added]

The huge earnings came as consumer gas prices rocketed to historic highs in June as Russia’s invasion of Ukraine, and widespread sanctions, roiled global oil markets. Exorbitant fuels prices have challenged family budgets across the country, not only forcing hard decisions about vacation getaways and everyday driving habits but also driving up the costs of groceries and most consumer and manufacturing goods, thanks to pricier-than-ever delivery costs.

7/27/2022 update starts here

Top headline: The Manila Times, 6/15/2022

Chart: Business Insider, 5/17/2022

Caricature: Tank Terminals

Bottom headline: Reuters

The world's largest energy traders, independents and majors, are poised to post record earnings for the first six months of the year due to volatility in markets caused by the Ukraine war and despite LNG supply problems, sources with the companies said.

Vitol, Glencore, BP, Shell and TotalEnergies have yet to report first-half 2022 results, but sources familiar with the companies indicated very strong returns and some rivals have already reported sky-high earnings.

7/23/2022 update starts here

Top headline: The Manila Times, 6/15/2022

Chart: Business Insider, 5/17/2022

Caricature: Tank Terminals

Bottom headline: Green Matters

The oil and gas industry is a top driver of greenhouse gas emissions and the climate crisis (no matter how much the industry tells you otherwise). And while fossil fuels continue to prevail primarily due to the money involved in the industry, reading the actual facts and figures on oil company profits and oil and gas industry profits is staggering.

7/18/2022 update starts here

So, Big Oil will be reporting in the last week of July another quarter of blockbuster earnings, this time aided by record refining margins as refining capacity globally is constrained, crude prices rallied in Q2, and fuel demand rebounded strongly.

Record refining margins and high earnings at the biggest oil corporations have been under continuous criticism by President Joe Biden and his Administration who have been warning firms against “profiteering” while gasoline prices hit records last month

6/22/2022 update, "It was only a matter of time until we got a crybaby response from a Big Oil CEO", starts here.

Chart: Business Insider, 5/17/2022

Headline: Reuters, 6/21/2022

The letter is the latest in a series of acrimonious exchanges between the U.S. oil industry and President Joe Biden over who is to blame for high fuel prices that have helped drive inflation to 40-year highs.

The White House asked the CEOs of seven refiners and oil companies including Chevron to a meeting this week to discuss ways to increase production capacity and reduce energy prices. Wirth said he would attend.

"Your administration has largely sought to criticize, and at times vilify, our industry," Wirth said in a letter to Biden. "These actions are not beneficial to meeting the challenges we face."

A couple of hours later, Biden told reporters in Washington the executive was being too sensitive.

6/20/2022 update, "Big Oil reports record profits while its execs enjoy a gushing payday", starts here.

Headlines: Financial Post, The Motley Fool

The Motley Fool gushes

Oil companies are increasingly returning their windfall to shareholders.

Oil profits have skyrocketed this year, fueled by surging oil prices. Most oil producers posted gushing profits in the first quarter, which will probably rise further in the second quarter because of higher prices. That's giving them a growing windfall to return to their shareholders.

Here's a look at why oil profits are so high and how you can cash in on the gusher.

6/18/2022 update, "Big Oil reports record profits while consumers empty their wallets at the pump", starts here.,

Headline: Media Matters for America

Media Matters analyzed 26 articles on high gas prices published from June 10-16 in the print editions of the five largest U.S. newspapers by circulation: The New York Times, The Washington Post, The Wall Street Journal, USA Today, and the Los Angeles Times. Media Matters coded the articles based on whether they included context about the record profits that oil companies are earning as a result of sustained high global oil prices.

We found that only 6 (23%) of the 26 articles analyzed made mention of oil company profits in coverage discussing the record high gas prices that are hurting consumers at the pump and through inflation. Notably, of the 6 articles that mentioned oil company profits, none quantified the recent record earnings of oil companies.

6/17/2022 update starts here

Headline: Alaska Native News, 6/16/2022

Chart: Business Insider, 5/17/2022

Caricature: Wikipedia

It’s far from clear, however, that Big Oil has any interest in voluntarily sacrificing record-shattering profits for the sake of providing any form of relief to consumers at the pump, where the average price of gas has surged past $5 per gallon on average nationwide.

6/15/2022 update starts here

GREED is really the engine of capitalism, global and local, as the current worldwide de facto oil crisis shows, in which prices soared from $70 per barrel at the beginning of the year to last week's $120. Everyone I know is shocked over the soaring, for instance, of the regular gasoline's price from P50 per liter in recent memory to P85 last week.

What few people know is that while the country groans under the weight of fuel costs, the industry continues to making a killing.

6/11/2022 update starts here

Headline and chart: Frederick News Post, 6/11/2022

Chart: Business Insider, 5/17/2022

Caricature: Wikipedia

In the first quarter of last year, Shell posted $3.2 billion in profit. During the same period in 2022, its fortunes ballooned to $9.1 billion. Exxon Mobil netted $2.7 billion in 2021 Q1, a figure that skyrocketed to $8.8 billion in 2022 Q1. Chevron’s Q1 profit more than quadrupled — from $1.37 billion in 2021 to $6.5 billion in 2022. Altogether, the five oil giants have amassed 300% more in profits this year than they did this time last year. This isn’t the result of the pandemic or the war. It’s just simple greed. [emphasis added]

Original 6/10/2022 post starts here

Headline and chart: Business Insider, 5/17/2022

Caricature: Wikipedia

Several of the world's largest oil companies reported first-quarter earnings in recent weeks, giving investors new detail as to how sky-high gas prices are bolstering firms' bottom lines. Performance, in a word, was stellar. ExxonMobil reported a net profit of $5.5 billion, more than doubling its earnings from the year-ago period. Shell notched its strongest quarterly profit ever, and Chevron posted its best earnings quarter in nearly a decade.

No comments:

Post a Comment