Link to October 7 Center on Budget and Policy Priorities Center report.

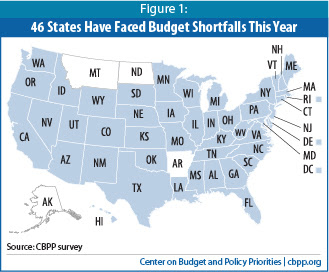

Excerpt: The worst recession since the 1930s has caused the steepest decline in state tax receipts on record. State tax revenues were 8.4 percent lower in the 2009 fiscal year than in 2008, and an additional 3.1 percent lower in 2010, while the need for state-funded services did not decline. As a result, even after making very deep spending cuts over the last two years, states continue to face large budget gaps. At least 46 states struggled to close shortfalls when adopting budgets for the current fiscal year (FY 2011, which began July 1 in most states). These came on top of the large shortfalls that 48 states faced in fiscal years 2009 and 2010. States will continue to struggle to find the revenue needed to support critical public services for a number of years, threatening hundreds of thousands of jobs. States face:

- Sharply constrained budgets in 2011. To balance their 2011 budgets, states had to address fiscal year 2011 gaps totaling $125 billion, or 19 percent of budgets in 46 states. Most did so with spending cuts and revenue increases.[1] This total is likely to grow over the course of the fiscal year, which started July 1 in most states. The fact that the gaps have been filled and budgets are balanced does not end the story. Families hit hard by the recession will experience the loss of vital services throughout the year, and the negative impact on the economy will continue.

- No diminishment in budget problems in 2012. States’ fiscal problems will continue in the current fiscal year and likely beyond. Only six states are reporting new mid-year shortfalls for fiscal year 2011 – a sign that conditions have stabilized compared to this time last year. But most states anticipate significant problems next year. Already 39 states have projected gaps that total $112 billion for the following year (fiscal year 2012). Once all states have prepared estimates these are likely to grow to some $140 billion.

"b/w" Link to November 28 Appleton Post-Crescent article.

Excerpt: With no federal regulations requiring businesses to collect sales tax on out-of-state purchases, the amount of uncollected revenue continues to grow as online shopping becomes a more popular option.

The Wisconsin Department of Revenue estimates that the state loses out on $150 million each year in sales taxes it's unable to collect from Internet sales and catalog purchases made by Wisconsin consumers who order items from out-of-state vendors.

Nationwide, estimates show that states collectively lose between $16 billion and $18 billion per year in unpaid sales tax, with $8.7 billion coming directly from online sales.

OK, just doing the math -- i.e., setting aside the reality of how difficult this change in tax law would be to implement -- $16-$18 billion per year would cover 13-14% of states' $125 million budget gap in 2011. Wisconsin's projected share of $150,000,000 wouldn't makes much of a dent in a $2,700,000,000 deficit. (5.5%). But you know it ain't gonna happen here.

No comments:

Post a Comment